LINE BK celebrates its first anniversary with over 3.4 million users

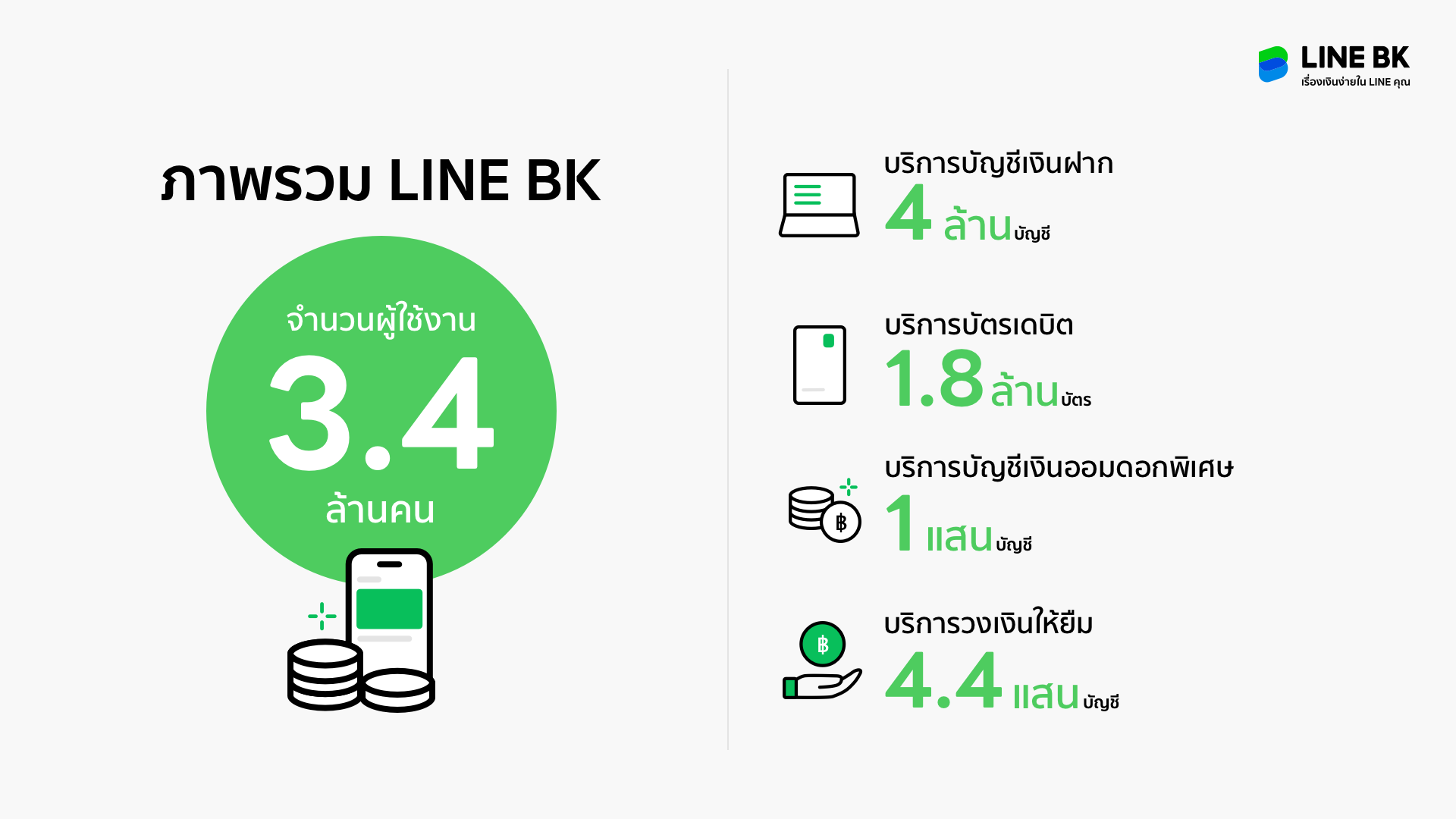

“LINE BK”, the first Social Banking platform in Thailand, marks its first anniversary with more than 3.4 million users, indicating that Thai people are open to new financial services offered via social platforms. It also reveals performance figures and customer behaviors through four main financial services comprising of Savings Account, Special Rate Account, Debit Card and Credit Line.

Tana Pothikamjorn, Chief Executive Officer of KASIKORN LINE, said after providing services for one year, LINE BK sees the trend that Thai people have become significantly more inclined to use services offered via digital channels including social banking and LINE BK currently has more than 3.4 million users. Major factors driving its growth are the Covid-19 pandemic, which caused people to stay home while shops and restaurants offered services only via online. This prompted consumers to use online services and migrate to digital banking transactions almost completely. It is also an opportunity for many financially stranded consumers to try LINE BK services particularly our personal loans, which has been getting a lot of interests.

Although it has been challenging to provide new services during the pandemic, LINE BK is moving forward with its business as planned. We have been seeing higher-than-expected interest in our services in the past year. LINE BK now has 4 million savings accounts, 100,000 special rate accounts, 1.8 million debit cards, and 437,000 loan accounts.

4 main financial services in Thai people’s lives

- Savings Account

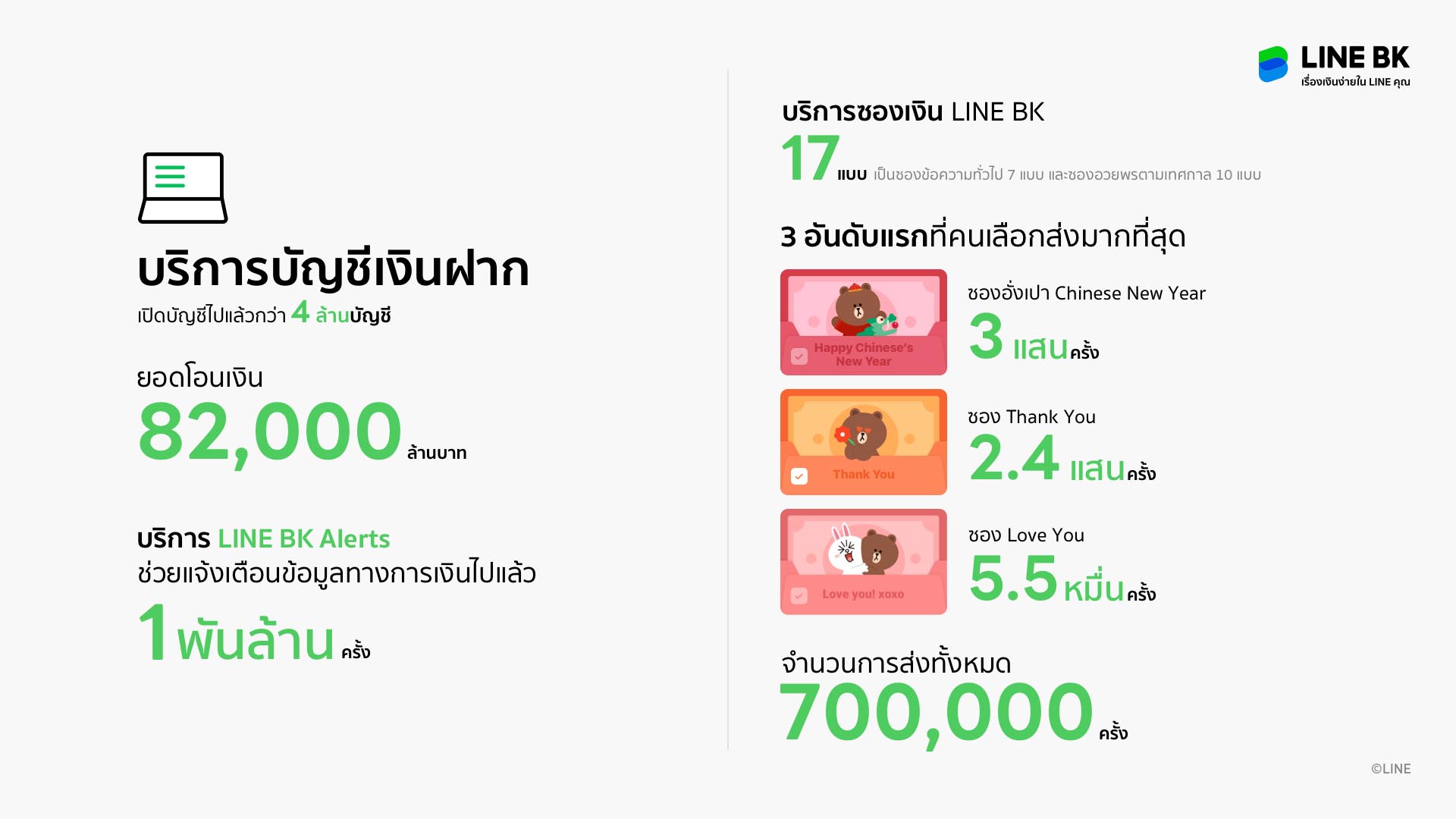

In the first year, 4 million savings accounts have been created with financial transactions worth over 82 billion baht. Customers have received money movement notifications, LINE BK alerts, more than 1 billion times in total. In addition, one of services that customers like the most when using LINE BK is a cute-design money envelope or transfer slip from LINE FRIENDS that can be used for general messages such as Thank You, Love You, Happy Birthday, Congratulations, and envelopes that come out for special festivals such as New Year, Chinese New Year, Valentine’s Day, Father’s Day, and Mother’s Day.

- Special Rate Account

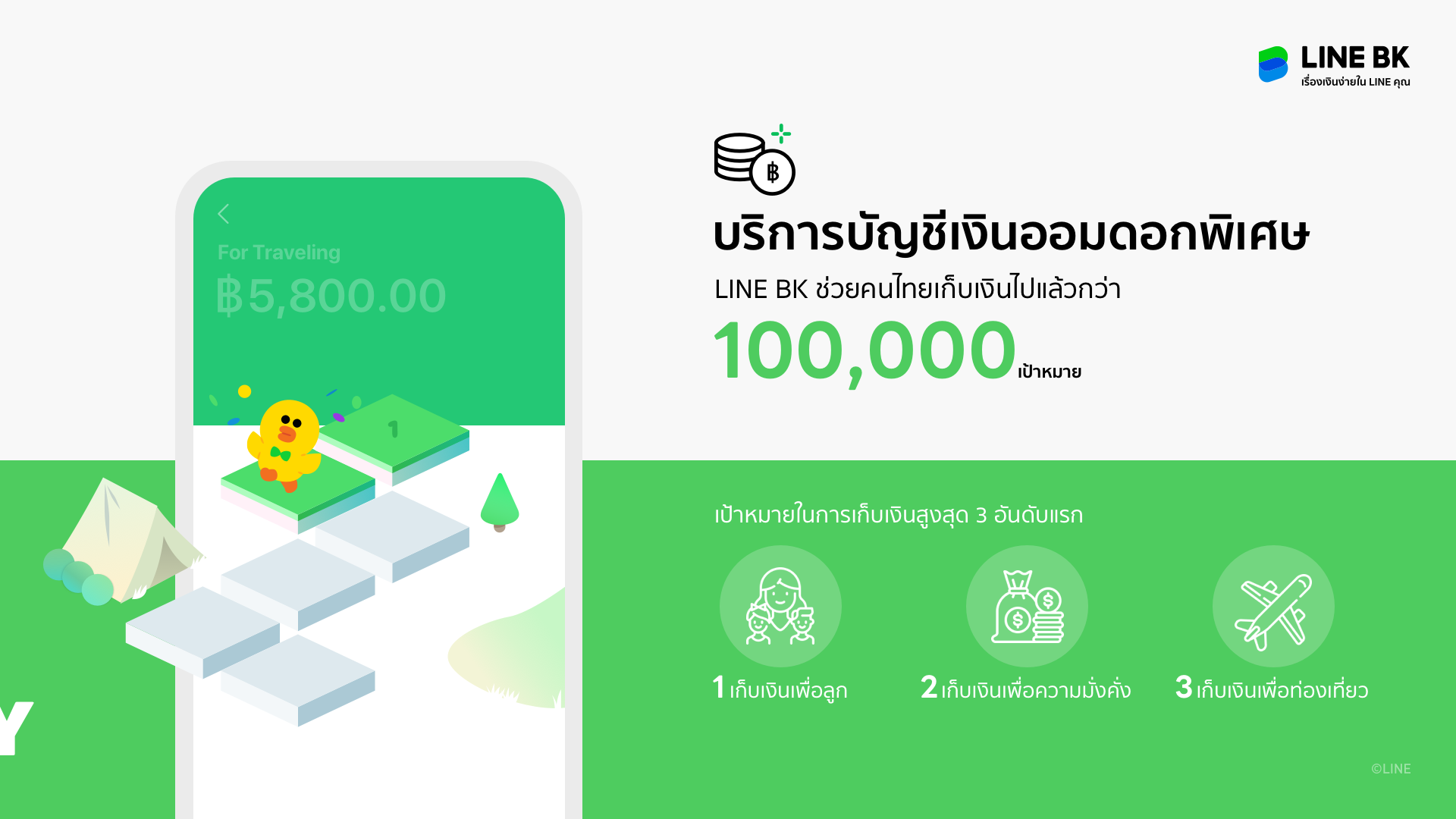

LINE BK’s special rate account is a service that helps build saving discipline for Thais with the automated saving system. Customers can set their saving target and duration and will receive a special interest rate up to 1.5% per year when they make savings for 12 months or 1% per year when they save their money for six months. Over the past year, LINE BK helped over 100,000 Thai individuals save their money under these special rates. Top three objectives for savings are to save money for children, save money for wealth, and save money for travel.

- Debit Card

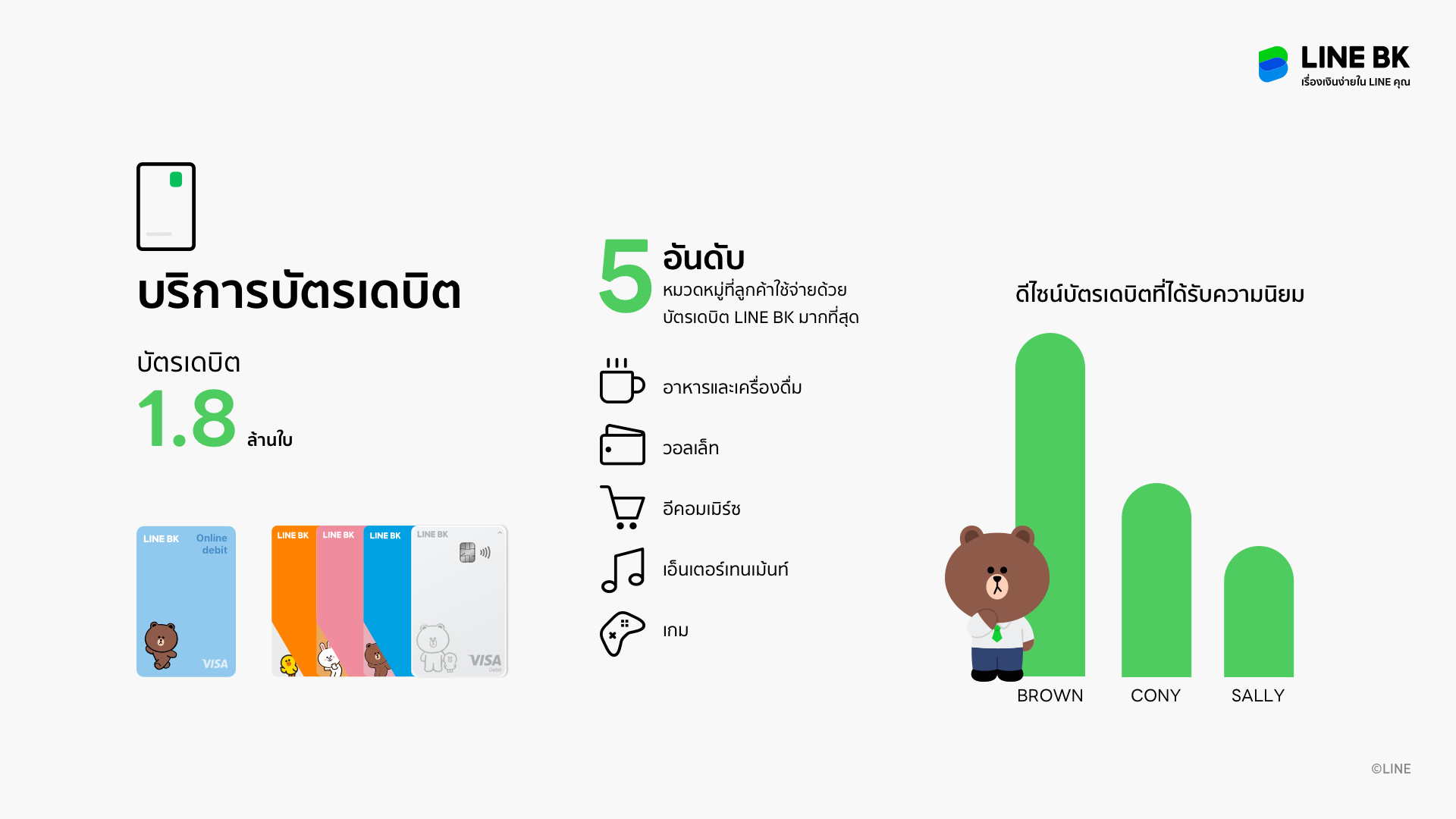

LINE BK’s Debit Card by VISA offers 3 types of debit cards designed to suit every lifestyle including Debit Card, Online Debit Card, and Debit Card with Credit Line. Its attractiveness is customers will receive 0.5% cash back from online purchases. Over the past year, 1.8 million customers have applied for all LINE BK’s debit card types and a majority went to Online Debit Card, which is consistent with the behavior of people to stay home during the Covid-19 pandemic and purchase products via online channel instead of going out for shopping at retail outlets. Top three categories that customers pay with LINE BK’s Debit Card are food and beverage, followed by the account link with Wallet, and product purchase via E-Commerce, and the most popular design for LINE BK’s physical debit card is BROWN bear, a LINE Friends character.

- Credit Line

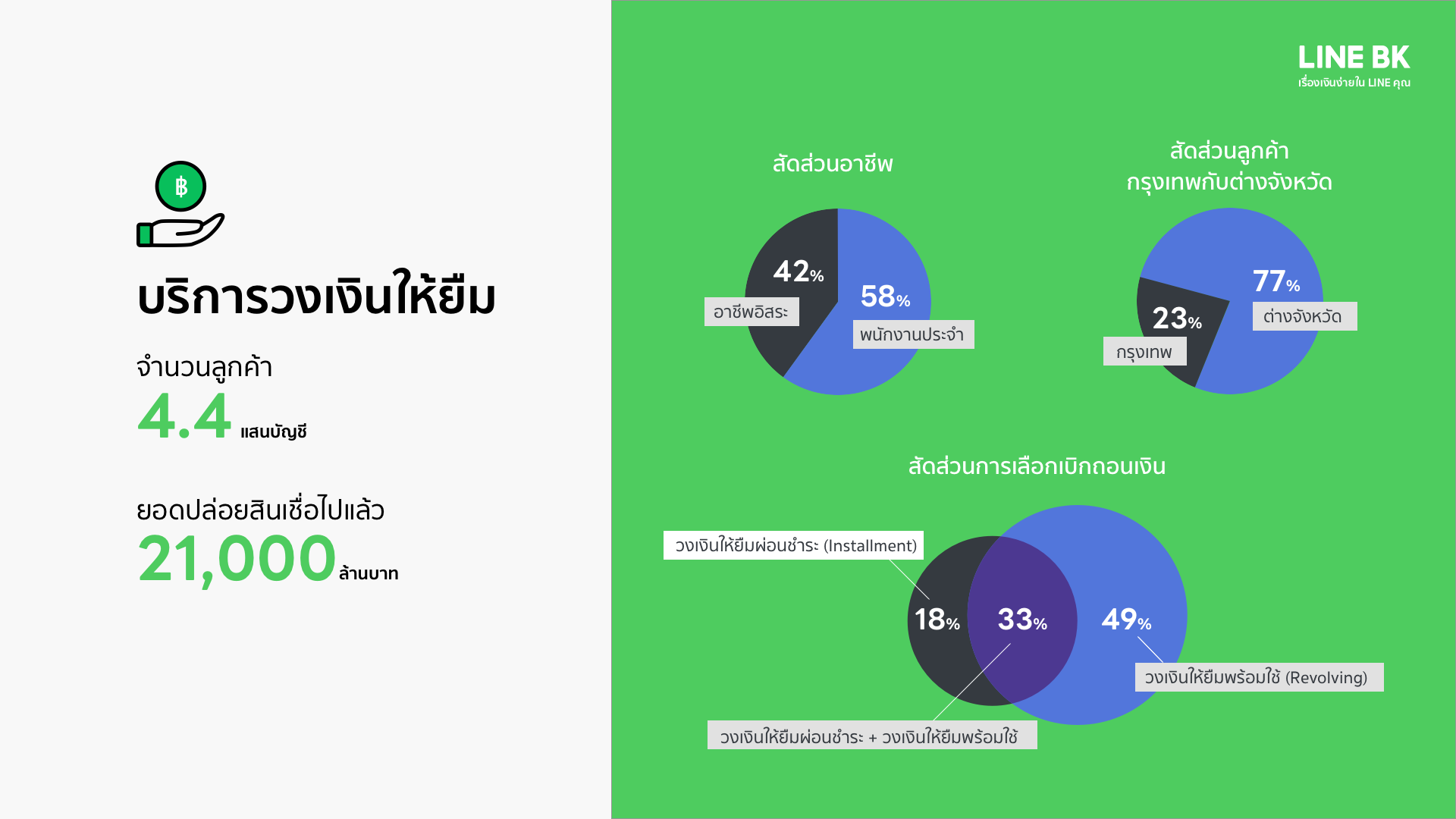

This is a core service designed to help Thais have an easy access to loans without complicated application procedures. Customers without fixed salary and pay slips or those with monthly income of at least 7,000 baht can apply for such the loans. Over the past year, this personal loan service has been gaining popular interests among customers. 437,000 accounts have been approved with total loan disbursed amount over 21 billion baht.

With LINE BK’s determination to help freelancers and those without fixed salary and pay slips access to a creditable source of funds, it found that nearly a half of LINE BK’s customers are freelancers and almost 80% of them live in provincial areas.

Partnership to fulfill the perfect Ecosystem

Another important factor making Thais quickly open their hearts to LINE BK, which is a new financial service to take part in every moment of customers, is service partners in various fields. Presently, LINE BK has already joined hands with more than 10 partners including VISA, Lazada, Agoda, Rabbit LINE Pat, LINE MAN, and dtac. All service partners help customers to stay online safely and smoothly throughout this pandemic.

1 year with 13 awards to guarantee its success

To reinforce its success over the past year, LINE BK has received 13 awards to guarantee service quality including:

THE DIGITAL BANKER: Digital CX Awards 2021

- Winner: Best Fintech for Digital CX - Personal Finance

- Winner: Best Digital Bank for CX – Thailand

- Highly Acclaimed: Best CX Business Model

- Highly Acclaimed: Best Digital CX Partner/Vendor

Efma: Financial NewTech Challenge 2021

- Winners: Bank + New Tech category

The Asian Banker: The Asian Banker Thailand Awards 2021

- Best Digital Lending Service in Thailand

The Asian Banker: The Asian Banker Financial Technology Innovation Awards 2021

- Best Lending Implementation

Juniper: Future Digital Awards 2021 Fintech & Payments

- The Platinum Winner in the ‘Challenger Bank of the Year’ category

Business+: Product Innovation Awards 2021

- The Winner in Category of financial & investment products - financial application, LINE BK

The Digital Banker: Global Retail Banking Innovation Awards 2021

- Winner: Best Digital Bank- Thailand

- Winner: Best Pure-Play Digital Account

- Winner: Outstanding Marketing Initiative for a New Product

Infosys: Finacle Banking Innovation Awards 2021

- Runners up Business Model Innovation

- “The first step of LINE BK was full of new challenges that all the time. The collaboration within the team and good partners made it possible for us to move forward strongly. Going forward, our mission is to strive for more innovative and efficient service development including the launch of new financial products and services to fulfill everyday moments to be convenient and safe, covering all the needs of customers following our ‘Banking in Your Hand’ concept within your LINE application,” Tana concluded.

Note: Statistics and figures are based on information during 15 October 2020 – 15 October 2021