Application

-

1. What are the qualifications and documents required for the Credit Line/ Nano Credit Line application?

-

Eligibility of applicants:

Credit Line Nano Credit Line - Individuals, aged of 20 - 60 years

- Thai nationality

- LINE BK Savings Account required or linked to K PLUS

- In case of employees, business owners or freelancers, must have an average monthly income of at least 30,000 baht.

- In some cases, customers may need to submit latest 6-month e-Statements (excluded current month) as additional income documents.

- Individuals, aged of 20 - 60 years

- Thai nationality

- LINE BK Savings Account required or linked to K PLUS

- Applicants have an average monthly income of at least 5,000 baht.

- In some cases, customers may need to submit latest 6-month e-Statements (excluded current month) up to 5 accounts as additional income documents.

-

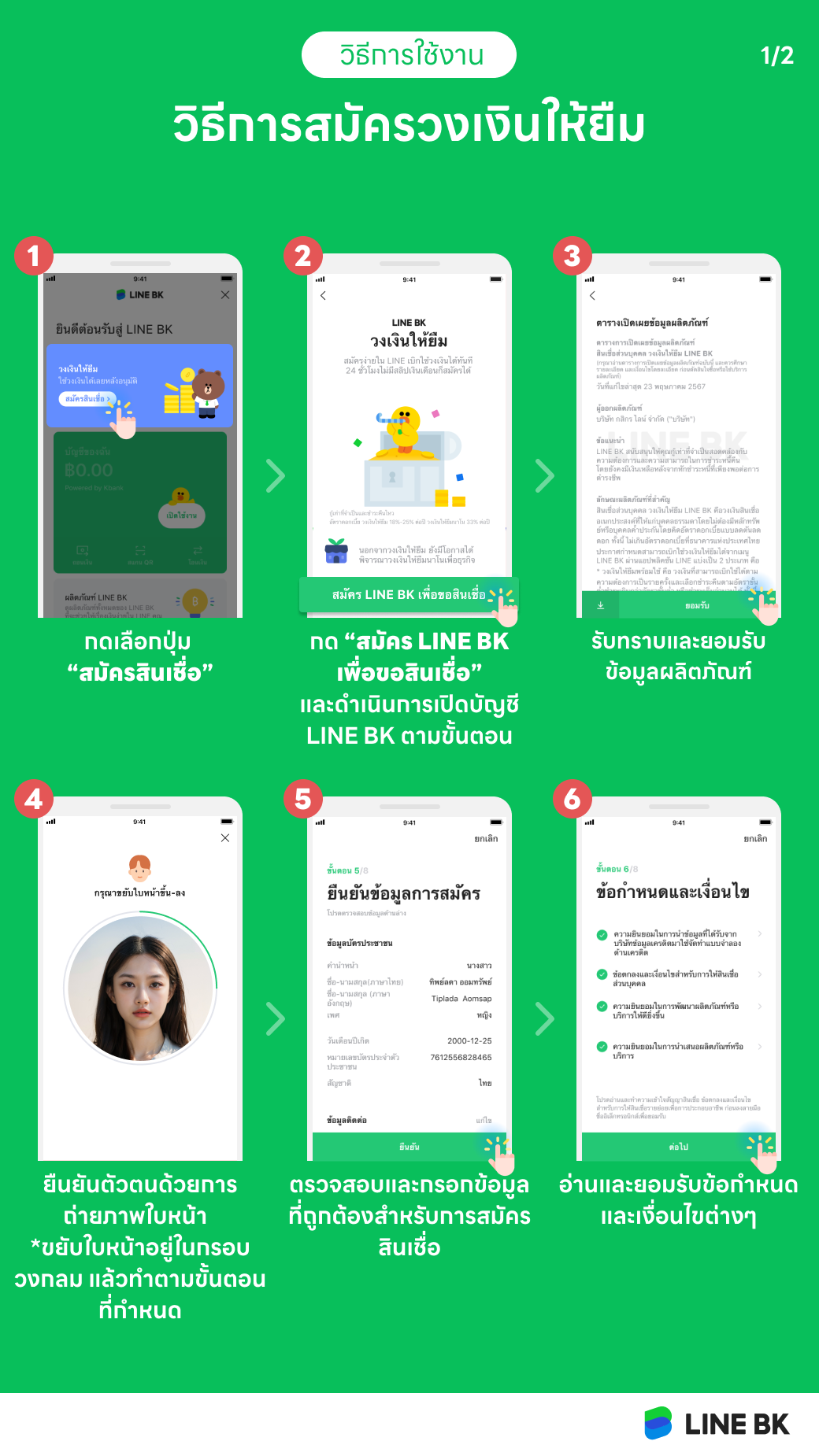

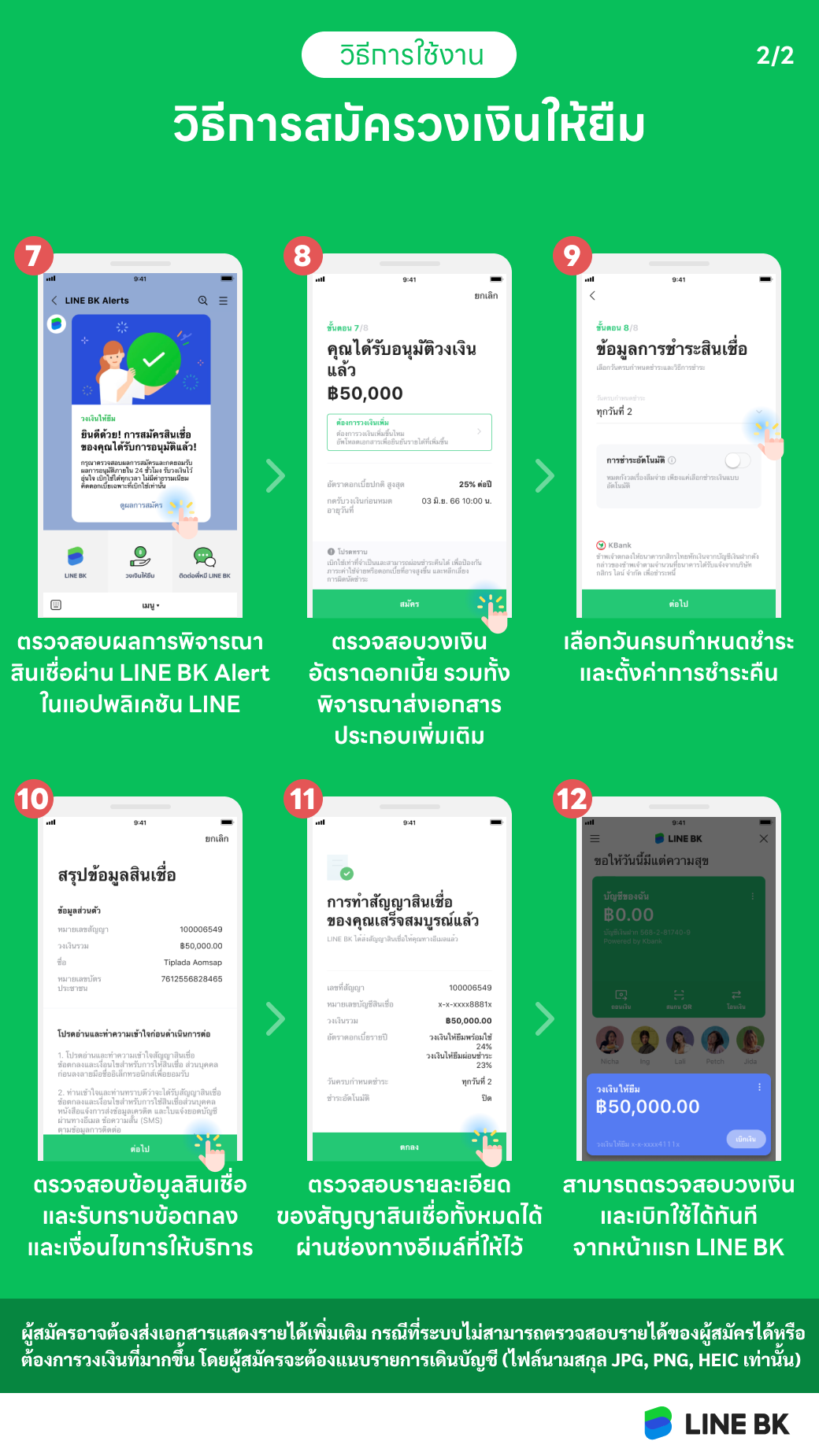

2. How do I apply for Credit Line/ Nano Credit Line (For New Customers)?

-

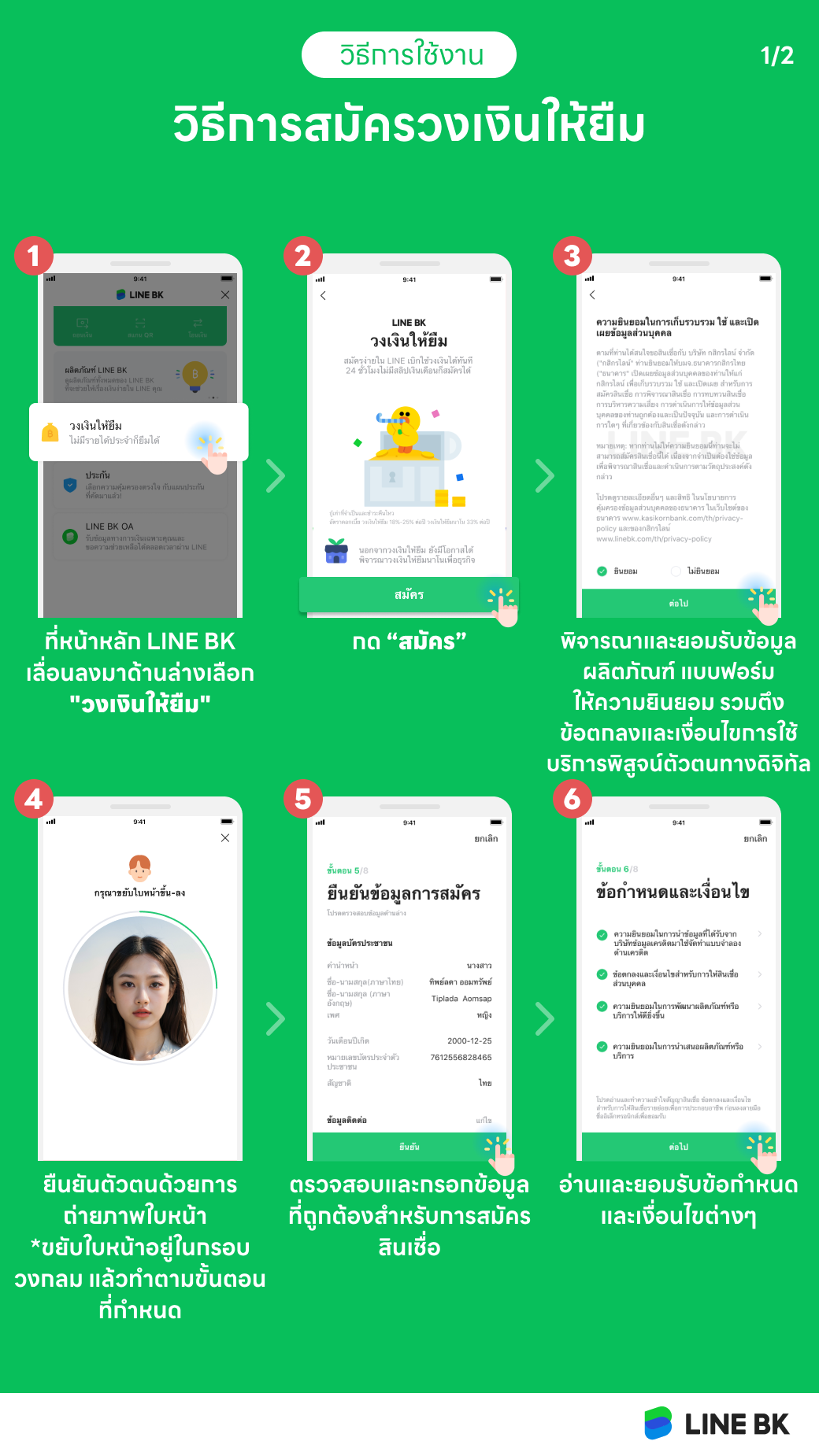

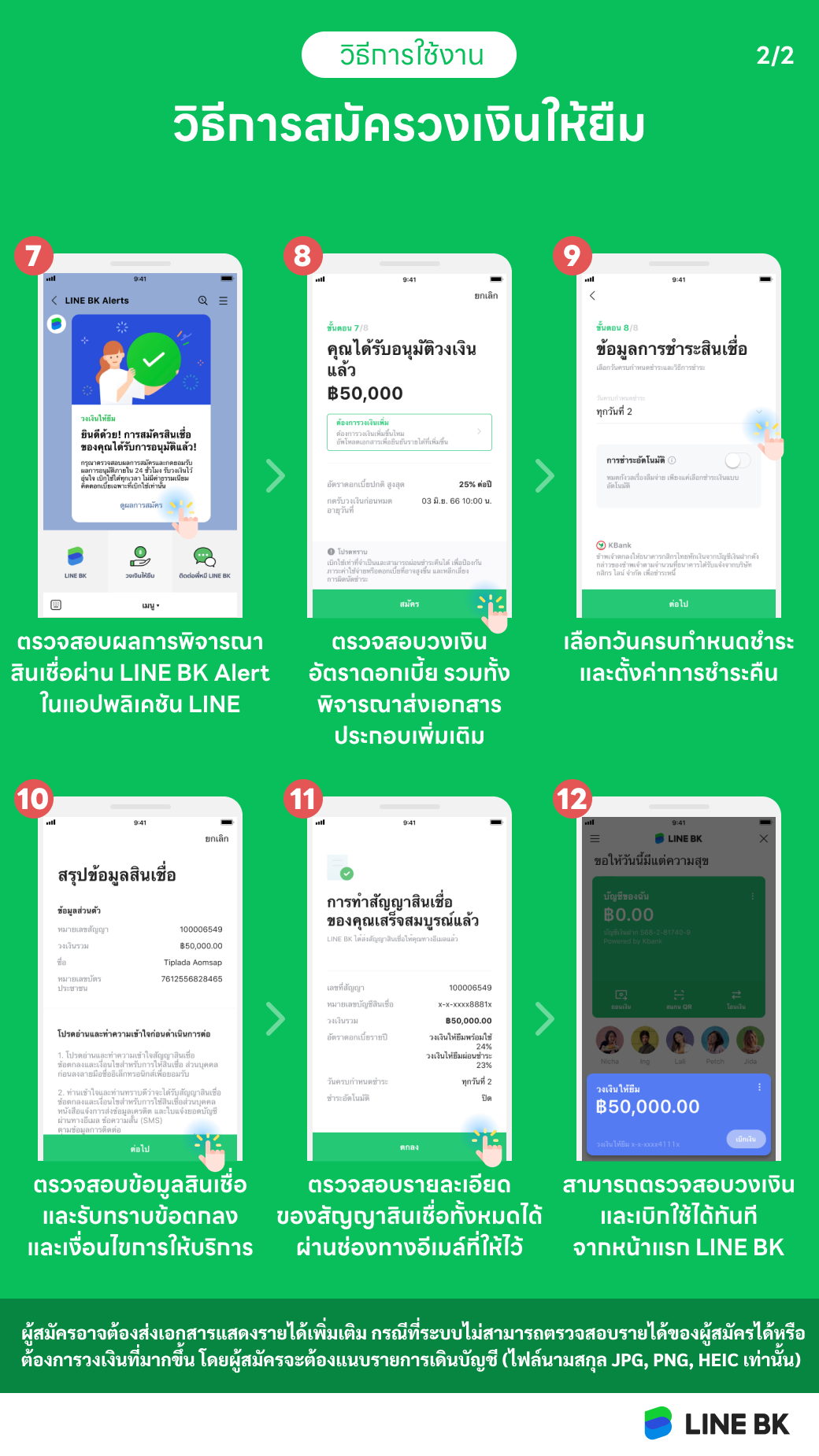

3. How do I apply for Credit Line/ Nano Credit Line (For Customers who already had LINE BK Savings Account)?

-

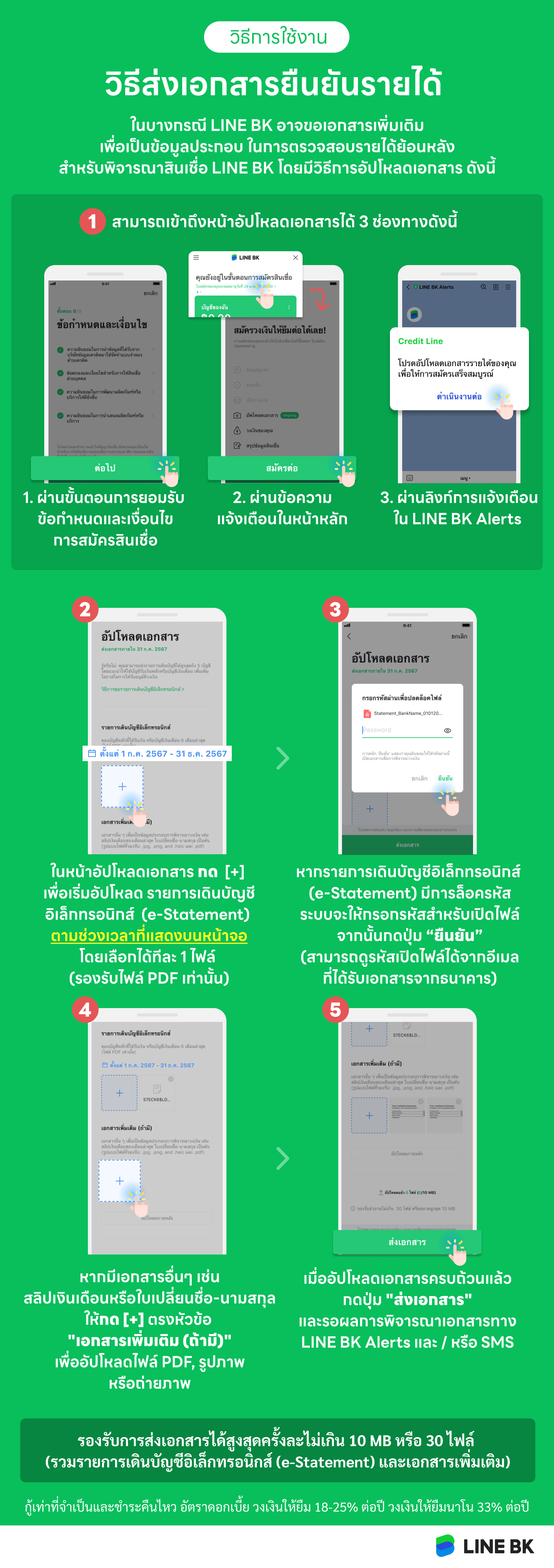

4. How to upload documents required for Credit Line/ Nano Credit Line application?

-

-

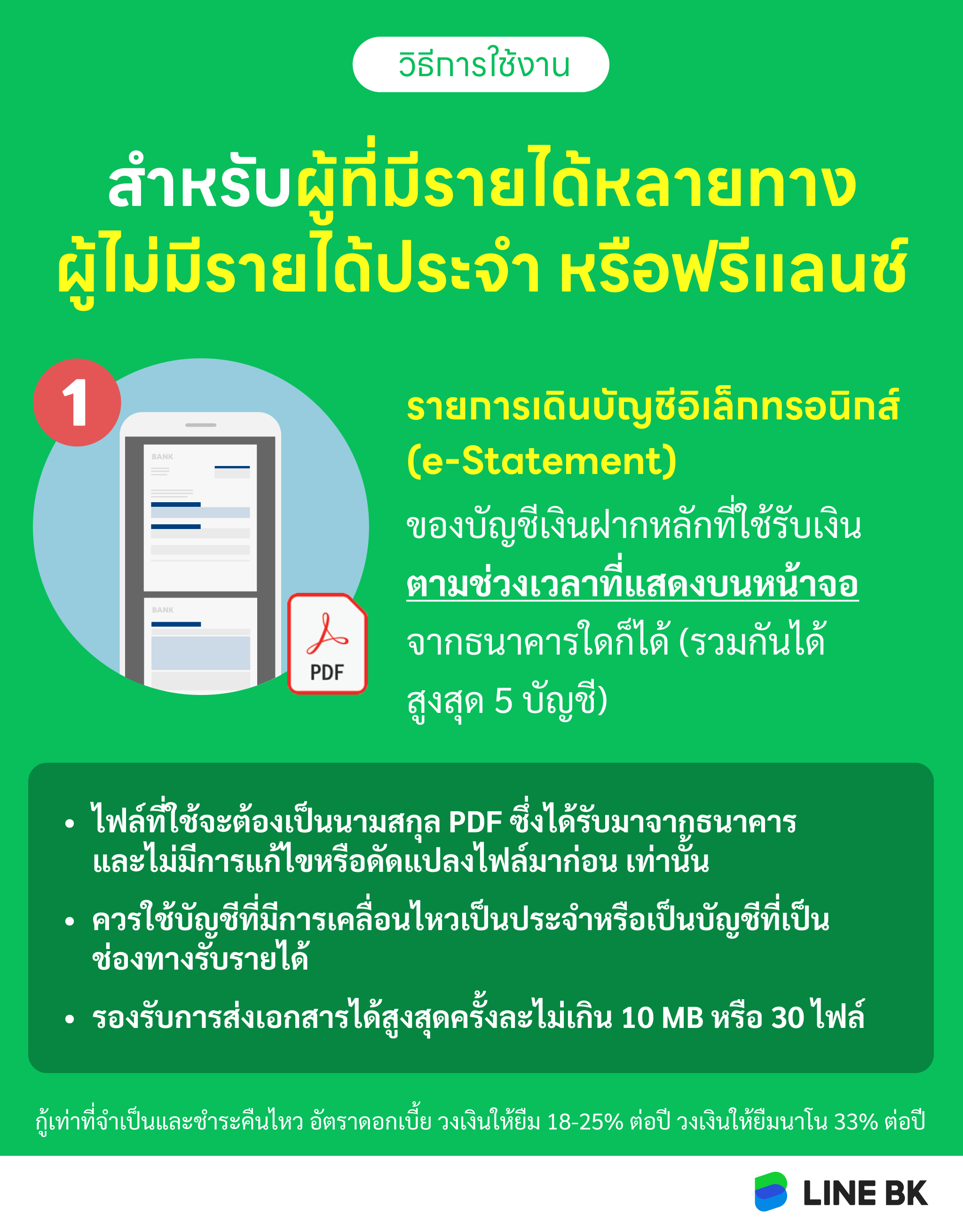

5. What are the documents required for freelance and self-employed person?

-

-

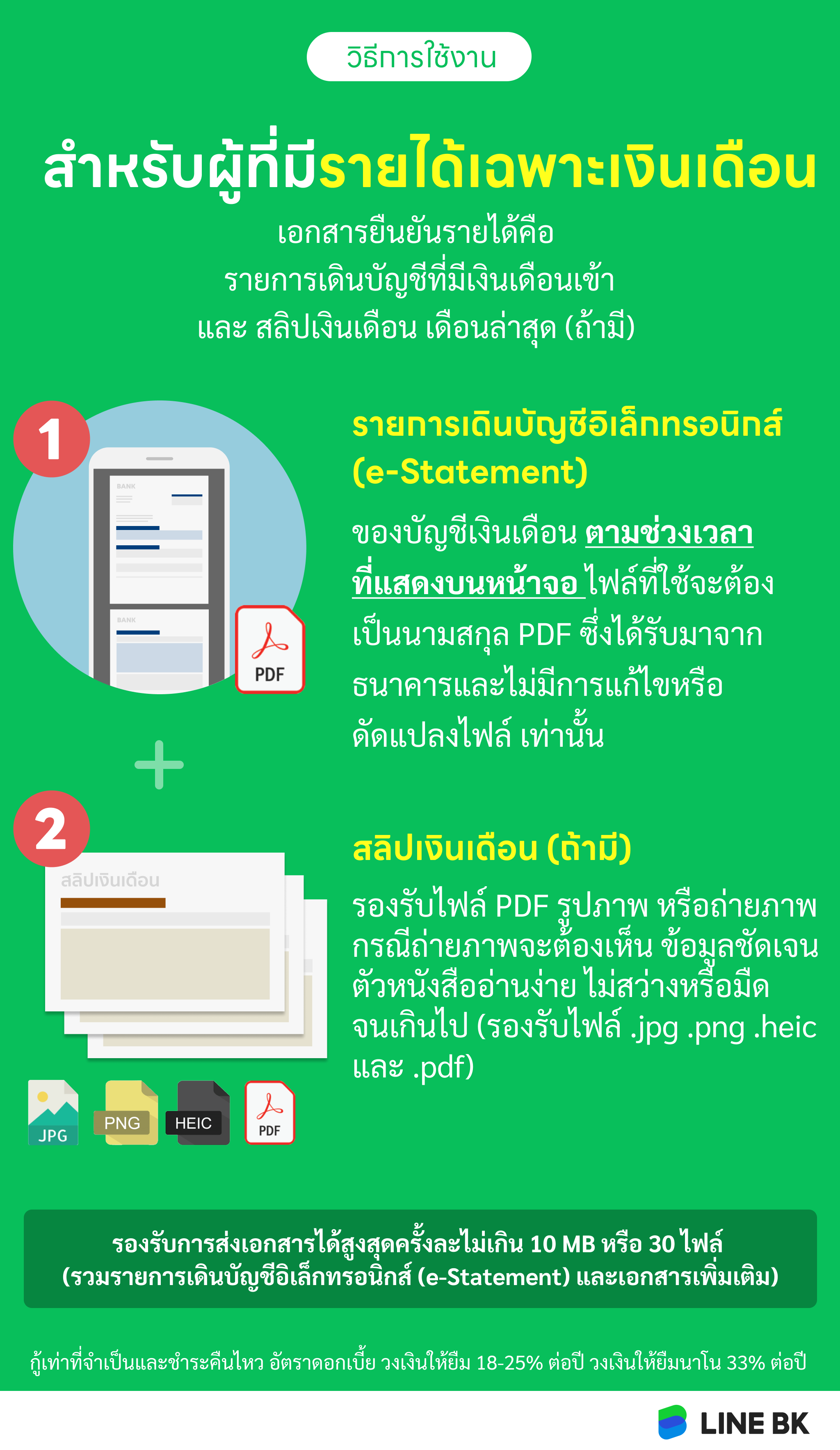

6. What are the documents required for salaried applicant?

-

-

7. How can I estimate my credit limit from my current income?

-

Can be approximately estimated by:

- Applicants with income equal or above 30,000 baht per month will receive credit limits* worth up to 5 times their monthly income

*The credit limit of approved applicants will depend on the policies and guidelines of the company.

-

8. What are the factors used for loan approval?

-

The company has several loan approval criteria, such as occupation, incomes of customers, number of loan accounts with other leading providers, payment history from NCB and internal policies and guidelines of the company.

-

9. Can I apply for Credit Line/ Nano Credit Line if I have missed or late loan payment history?

-

Our company's policy has no objection to allowing customers to apply for loan, but the approval consideration will be reserved to our internal policy. Not only credit bureau information but we also review other loan approval criteria such as occupation, incomes of customers, number of loan accounts with other lending providers, payment history from NCB and guidelines of the company.

-

10. How long does the Credit Line/ Nano Credit Line approval process take?

-

In case the income documents are not required, the application result will be shared within the same day. If the income documents are required, the application result will be shared within 1-3 working days after uploading. However, In case of incomplete documents, LINE BK will request the additional document via SMS/Email registered and it will take additional 1-3 working days for document verification.

-

11. Can I apply for the Credit Line if I am self-employed?

-

If you are a business owner or a freelancer, you can apply for the Credit Line with 6 months (excluded the latest month) statements (up to 5 accounts) as income documents.

-

12. What is the maximum credit limit of LINE BK Credit Line/ Nano Credit Line?

-

Product Max Credit Limit Credit Line No more than 5 times monthly income and is not exceeding 800,000 Baht. Nano Credit Line Maximum of 100,000 Baht -

13. What is the difference between Credit Line and Nano Credit Line?

-

- Credit Line is Personal loans under the supervision of the Bank of Thailand with the maximum interest rate of not more than 25% per year.

- Nano Credit Line is the loan which is designed to support financial needs for small business owners and salary earned person to start their extra business with the maximum interest rate of not more than 33% per year.

-

14. Which channel will I receive the Credit Line/ Nano Credit Line approval result?

-

The company will notify the Credit Line/ Nano Credit Line approval result via one of the following channels; LINE BK Alerts, LINE BK application, or letter.

-

15. Is it possible to get approval for both Credit Line and Nano Credit Line?

-

LINE BK will ensure you have got the best products that suits your purpose. As a results, each customer will get only one loan product either Credit Line or Nano Credit Line.

How to use

-

1. How do I check my Credit Line information?

-

-

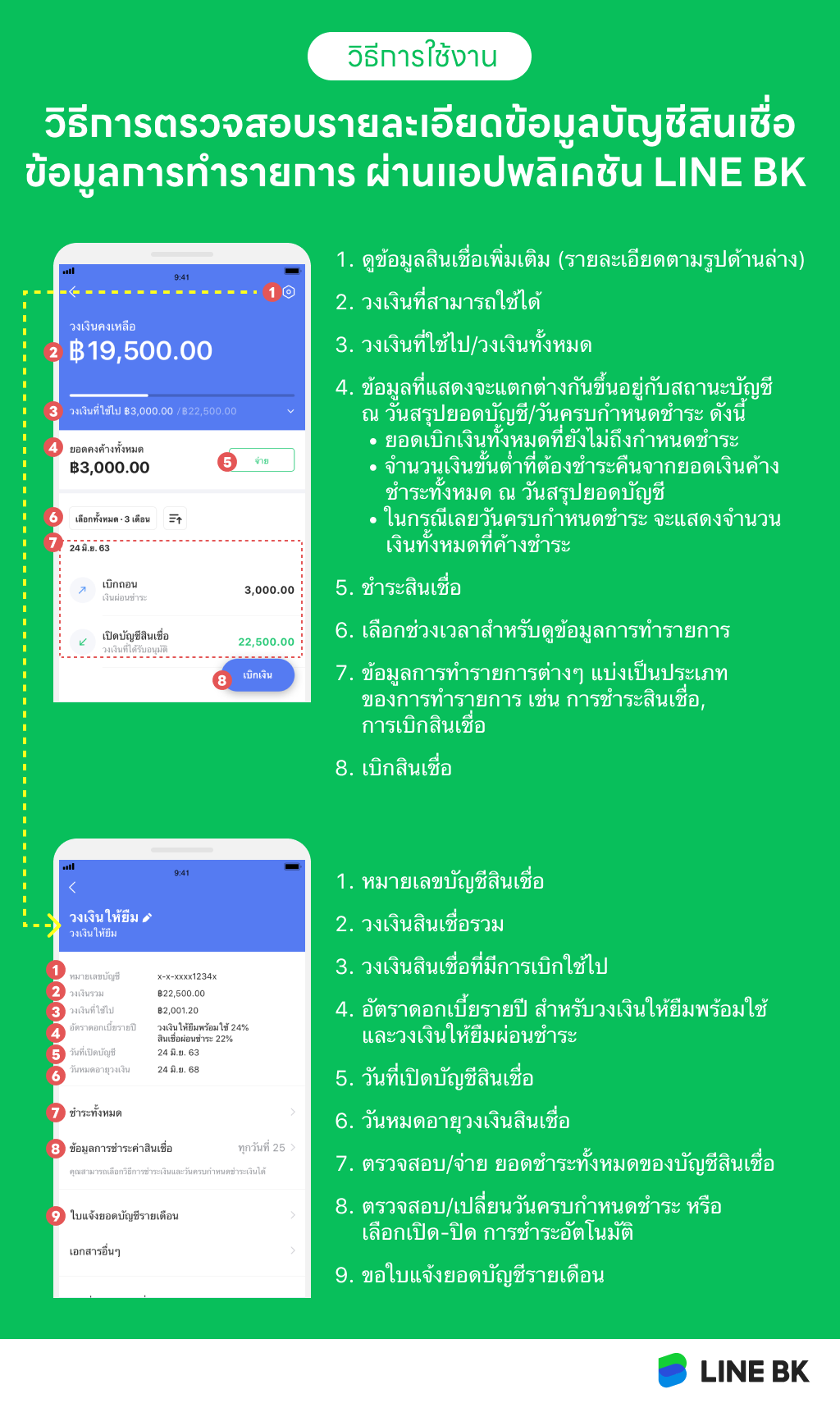

2. How to check loan account details and transaction information through the LINE BK application?

-

Disbursement

-

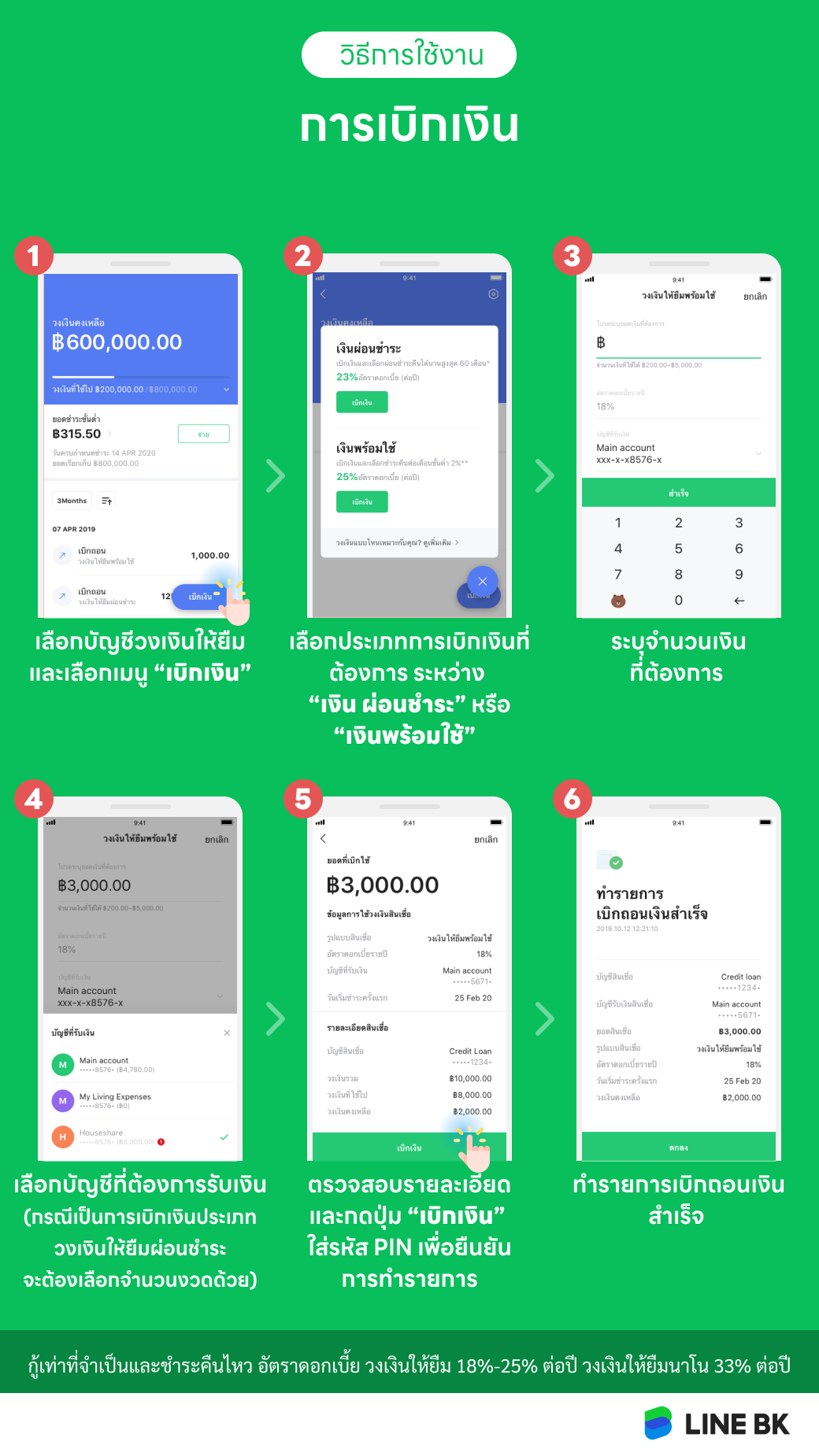

1. How do I disburse from my Credit Line/ Nano Credit Line?

-

You can disburse from Credit Line account via LINE BK application.

-

2. What is a time I can disburse the money from my Credit Line/ Nano Credit Line account?

-

You can disburse the money from your Creit Line/Nano Credit Line anytime via LINE BK application.

Payment

-

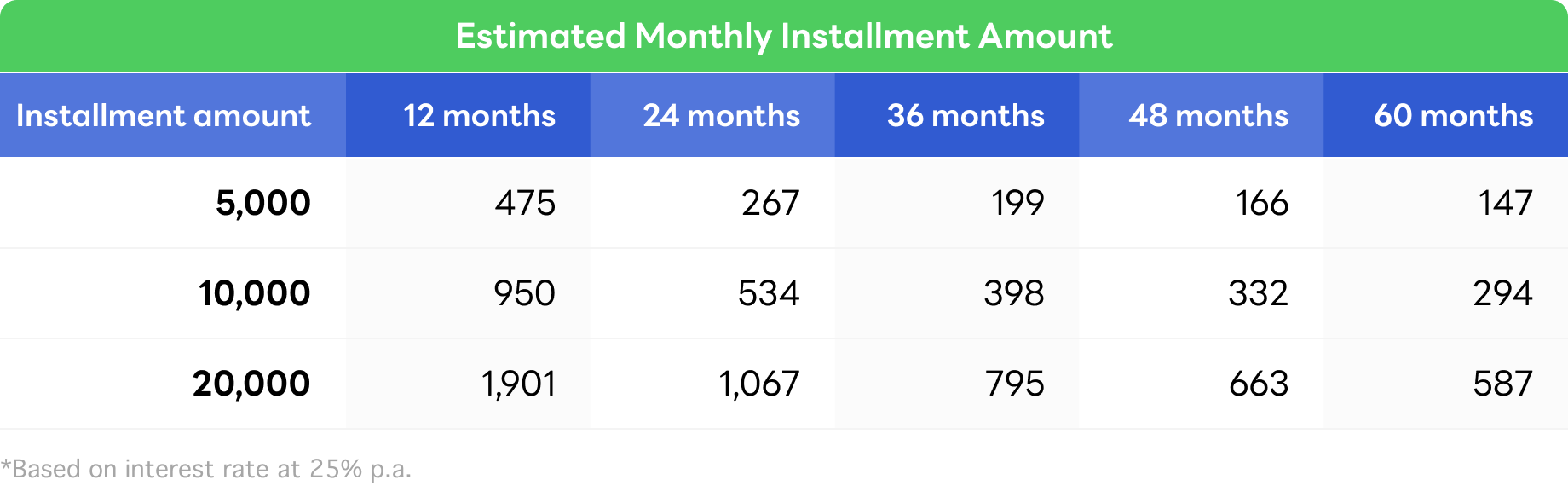

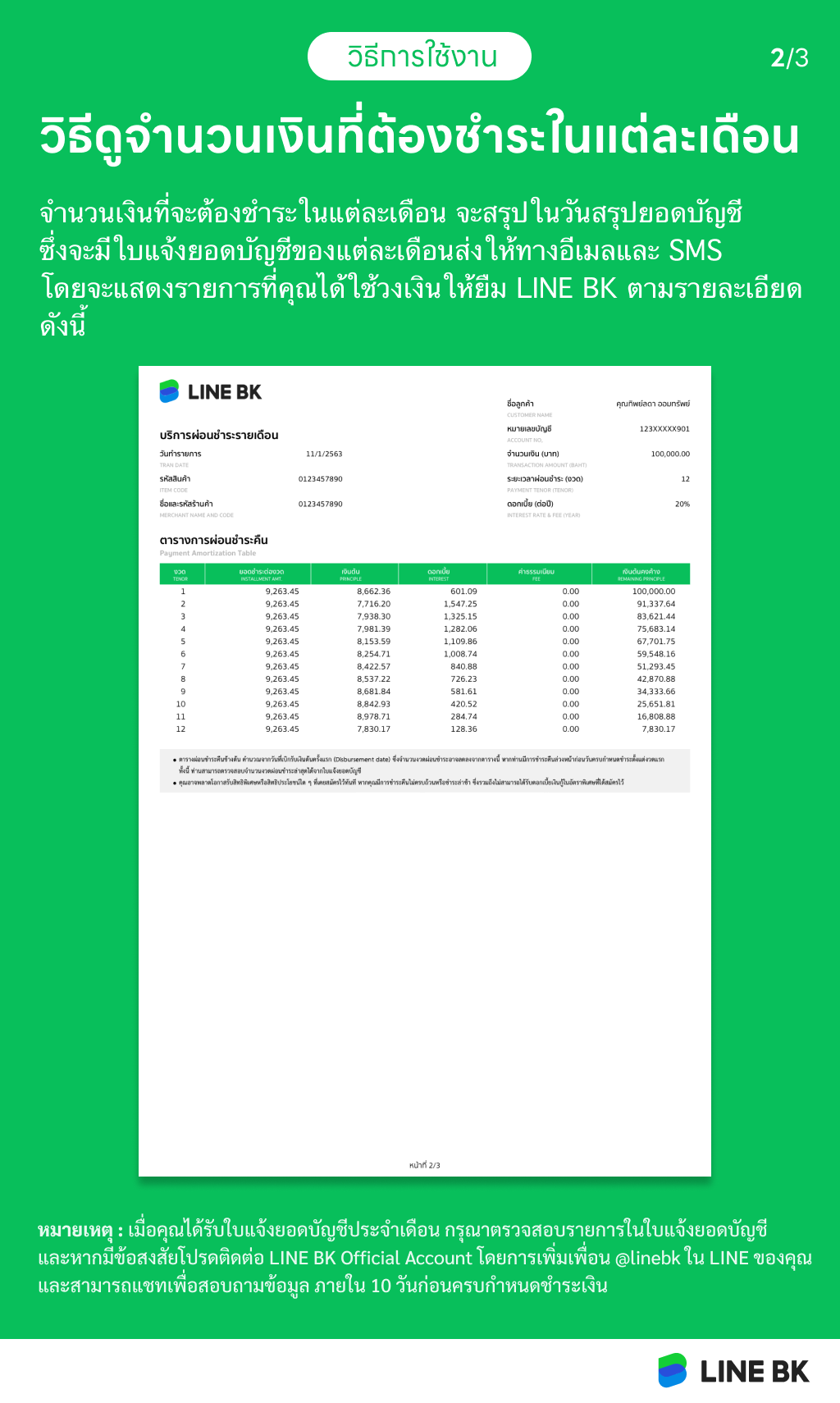

1. Sample payment amount of Installment loan

-

- Minimum installment tenor 12 months*

- Maximum installment tenor 60 months*

*Remark: Max tenor for installment repayment depends on credit line type, customer risk profile, monthly repayment amount and loan effective period

-

2. How to repay the bill of my Credit Line/Nano Credit Line?

-

There are 3 payment channels as follows with no payment fees:

2.1. Automatic payment from your LINE BK Savings Account. You can set this feature through LINE BK.

2.2. Manual payment from your LINE BK Savings Account.

2.3. Make a payment via payment providers using QR code.

Suggestion: No worries from loan overdue by choosing automatic payment. The minimum due amount will be deducted from your linked savings account on payment due date

-

3. How to repay my Credit Line/ Nano Credit Line using automatic payment from my savings account in the LINE BK application?

-

-

4. How to repay my Credit Line/ Nano Credit Line from my LINE BK savings account?

-

5. How to repay my Credit Line/Nano Credit Line using QR code?

-

6. What is the difference between billing date and due date?

-

- Billing date is the date that summarizes the account balance for the period.

- Due date is the date that payment is due.

-

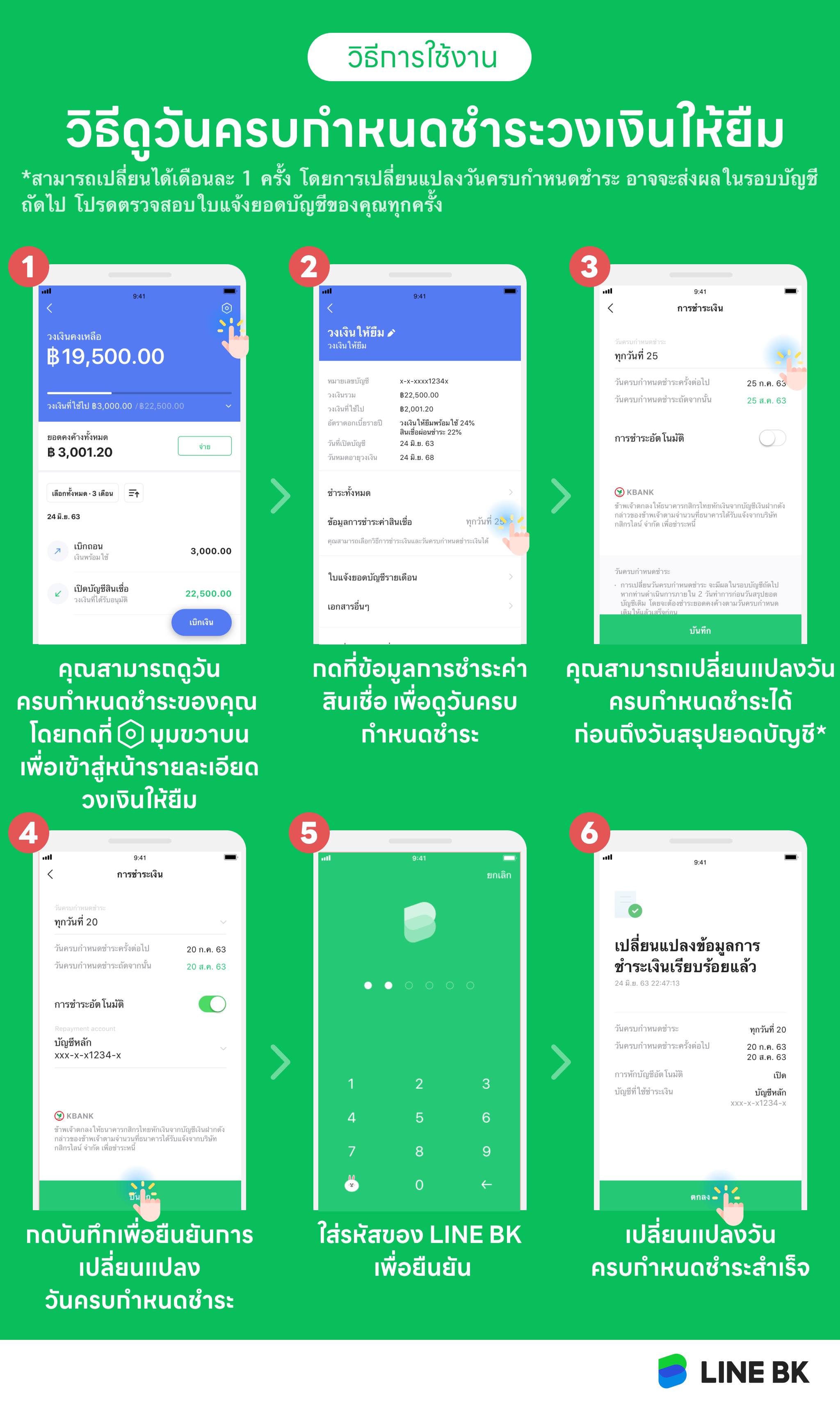

7. How to check my payment due date?

-

-

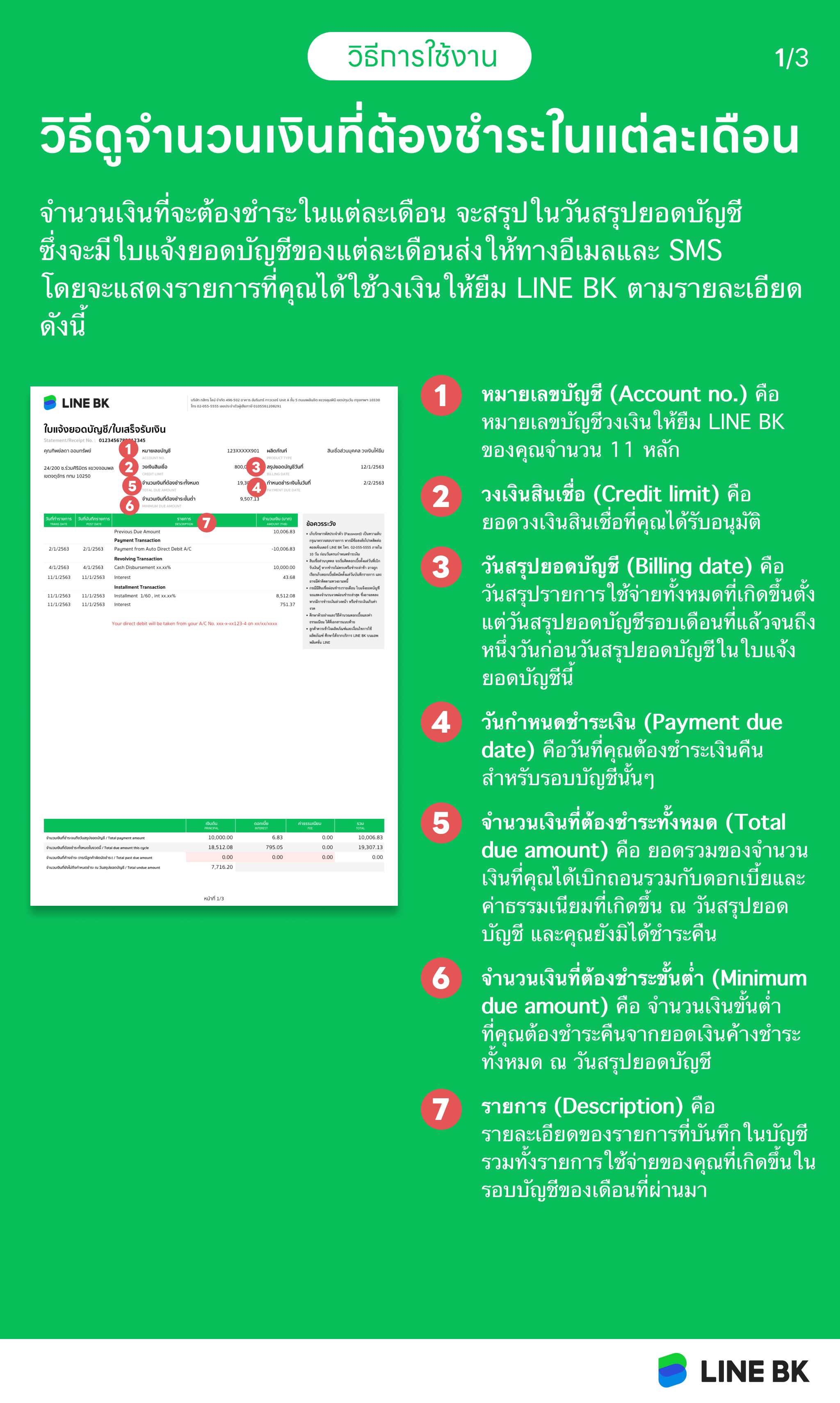

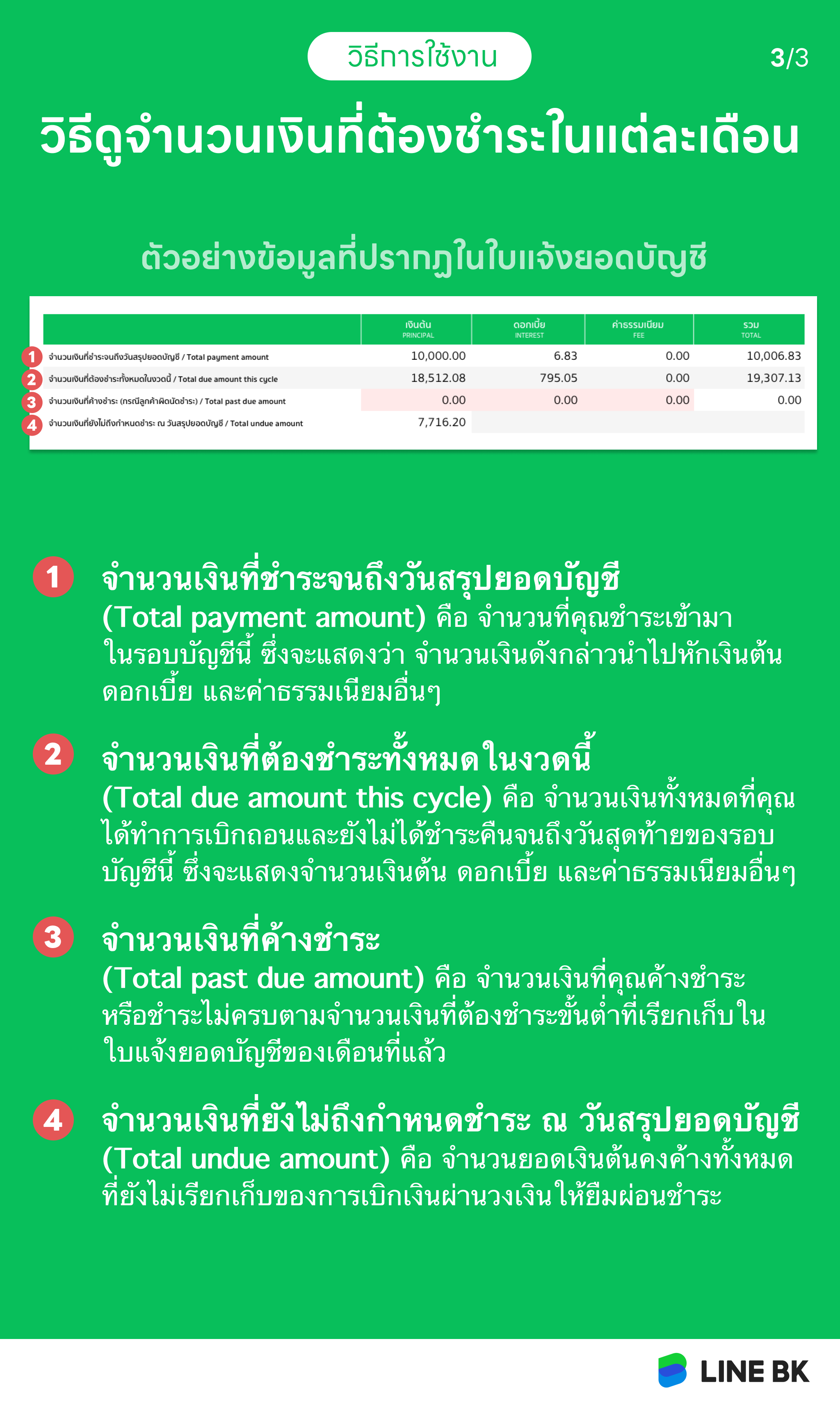

8. How to check my monthly due amount on statement?

-

-

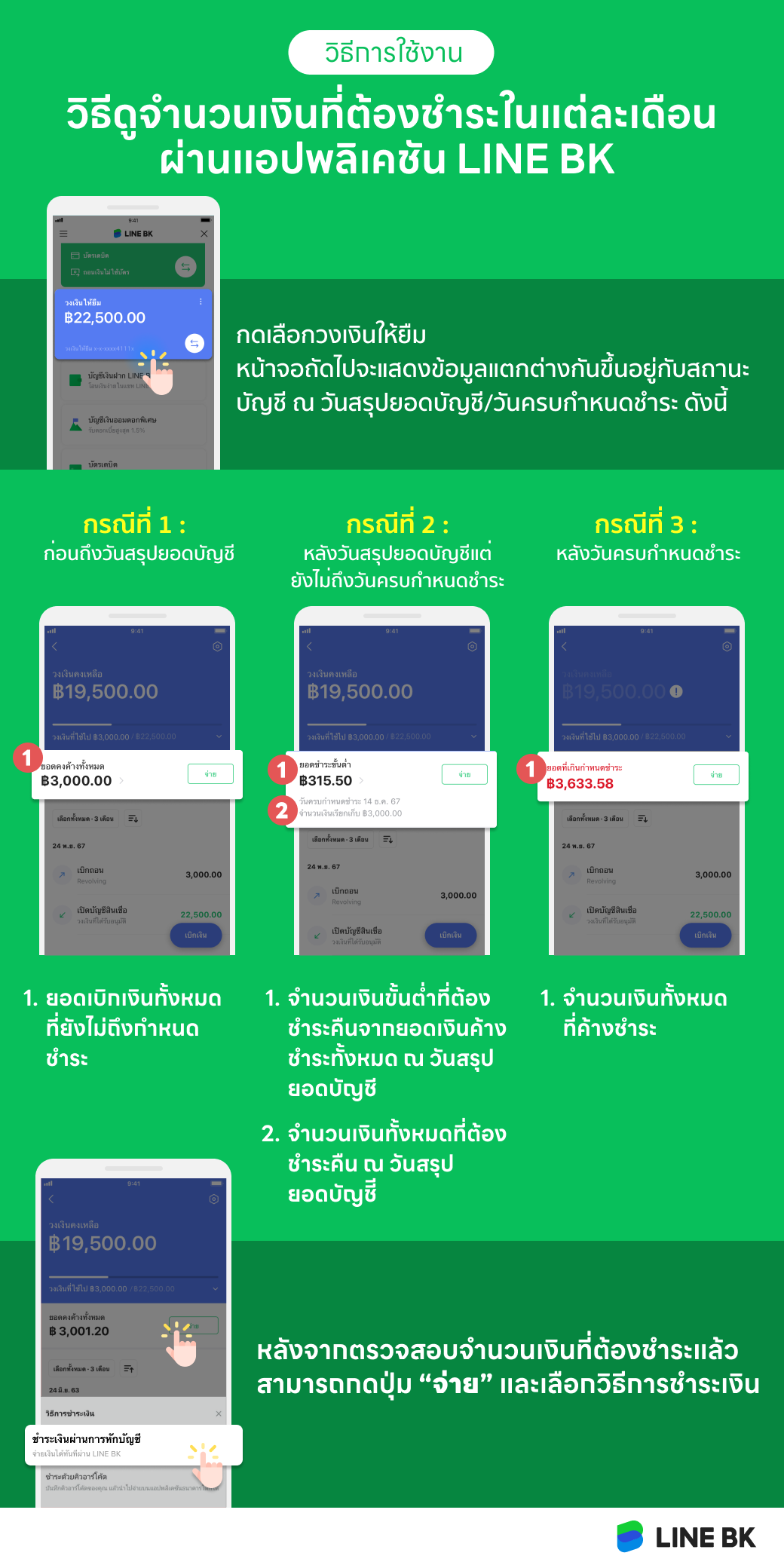

9. How to check my monthly due amount through the LINE BK application?

-

-

10. What is the impact if I missed payment for my Credit Line / Nano Credit Line, Do I have to pay additional fees

-

Once you disburse loans, you must pay a principal amount with an interest rate upon the payment schedule stated in the statement. If you fail to make a payment on the due date or late repayment, you may have an extra burden and a higher interest rate charged as per your default interest rate. You also may be ineligible for special interest rates and any special privileges, including decreasing or suspending your credit limit.

Please note that the additional default interest rate will not exceed 3% p.a. from your regular interest rate. However, the interest rate charged in total will not exceed 25% p.a. for Credit Line and 33% p.a. for Nano Credit Line.

-

11. If I missed a payment and my Credit Line / Nano Credit Line is suspended, what should I do to use my credit limit again?

-

You must pay off outstanding balances or choose to pay the minimum due amount to be able to use the credit limit again. If you repay after the due date, you can disburse the credit limit again on the next day. After successfully repaying, if you are still unable to use the credit limit, please verify that you have paid the minimum due amount for this billing cycle or you have enough remaining credit limit for use.